Reimbursement of Childrens Education Allowance (CEA) claim for Central Government employees for the academic year 2020-2021

Reimbursement of CEA claim

CEA claim for Central Government employees: For the academic year 2020-2021, reimbursement of the Children Education Allowance (CEA) claim for Central Government employees.

Central Government employees are now eligible to apply for CEA claim for their wards for the academic year 2020-2021 from 01.04.2021. The following are the guidelines to apply for reimbursement of the 7th CPC Children education allowance for their children as per the DoPT orders.

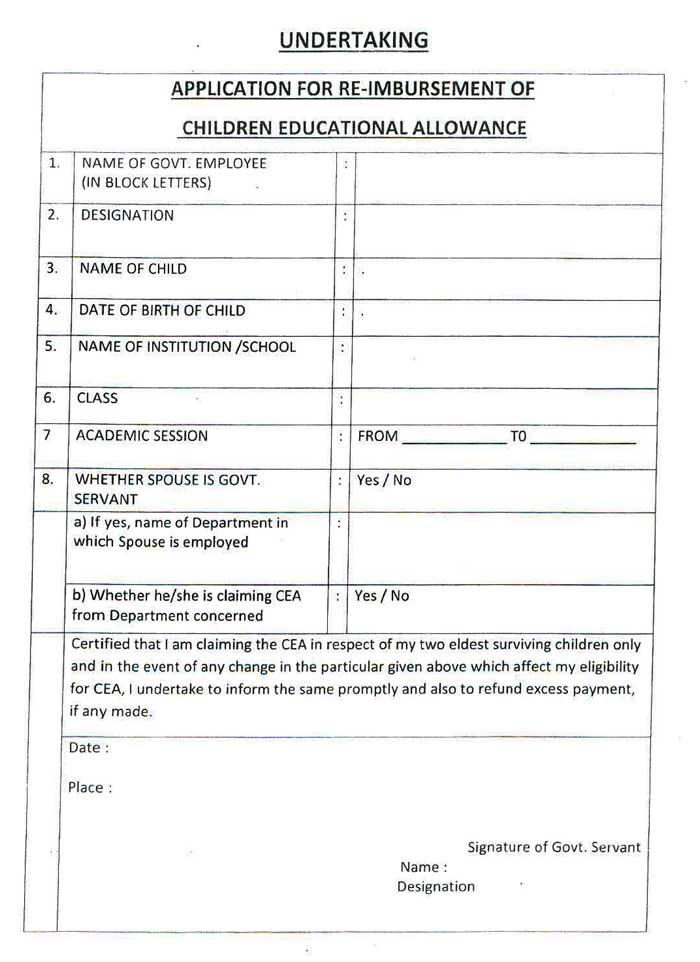

The reimbursement of Children Education allowance / Hostel subsidy can be claimed only for the two eldest surviving children. In case, if the second child birth results in twins/multiple births, the condition would not be applicable for the second birth children.

The amount of reimbursement of Children education allowance will be Rs 2250/- per month {fixed} per child. This amount is of Rs 2250/- is fixed irrespective of the actual expenses incurred by the Govt Servant. Hence, the total amount of claim will be Rs 27000/- per academic year. Provided that during any period which is treated as “dies non”, the Government servant shall not eligible for the CEA/Hostel Subsidy for the period. The claim is eligible for the child studies from Class first to Class twelfth standard plus two classes before the First standard. {i.e} either among the three classes from Preschool, LKG & UKG only two classes are eligible for reimbursement. Most of the Government employees usually make claim to Kinder Gartens classes only.

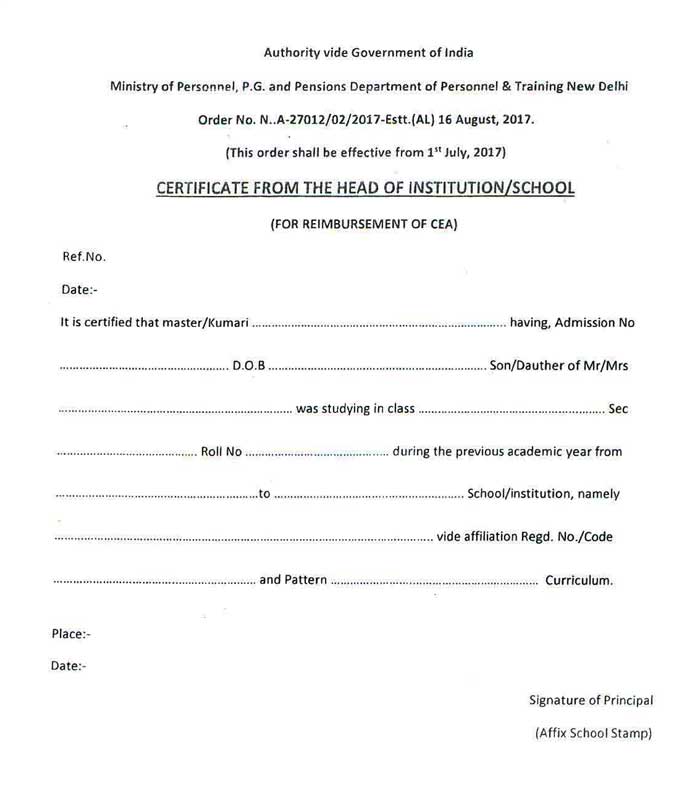

The reimbursement of Children education allowance can be made by an application with a production of Bonafide certificate issued by the Head of the Institution for the period/year for which claim is preferred. The certificate should confirm that the child studied in that school during the previous academic year. Cash paid bills to the school institution are not mandatory for the claim. The school should be recognised by the State/Central/Any other board of the institution.

The reimbursement of Children education allowance for Divyaang Children {Disabled Children} of Government employees shall be payable at double the normal rates of CEA i.e Rs 4500/- per month {fixed}.

In case both the spouses are Government servants, only one of them can avail reimbursement under Children Education Allowance and Hostel Subsidy.

CEA is allowed in case of children studying through “Correspondence or Distance Learning” subject to other conditions laid down herein.

The reimbursement of Children education allowance and Hostel subsidy shall have no nexus with the performance of the child in his/her class. In other words, even if the child fails in a particular class, the reimbursement of Children education allowance and Hostel subsidy shall not be stopped.

As per the Department of Personnel & Training (DoPT) this CEA will go up when the Dearness Allowance (DA) on the revised pay structure goes up by 50 per cent. According to the DoPT norms, a central government employee is eligible for the CEA for two children only and the CEA will go up by 25 per cent automatically when the DA rises 50 per cent of the revised pay structure. However, in the case of a Divyang child, the CEA gets doubled at Rs 4,500 per month.

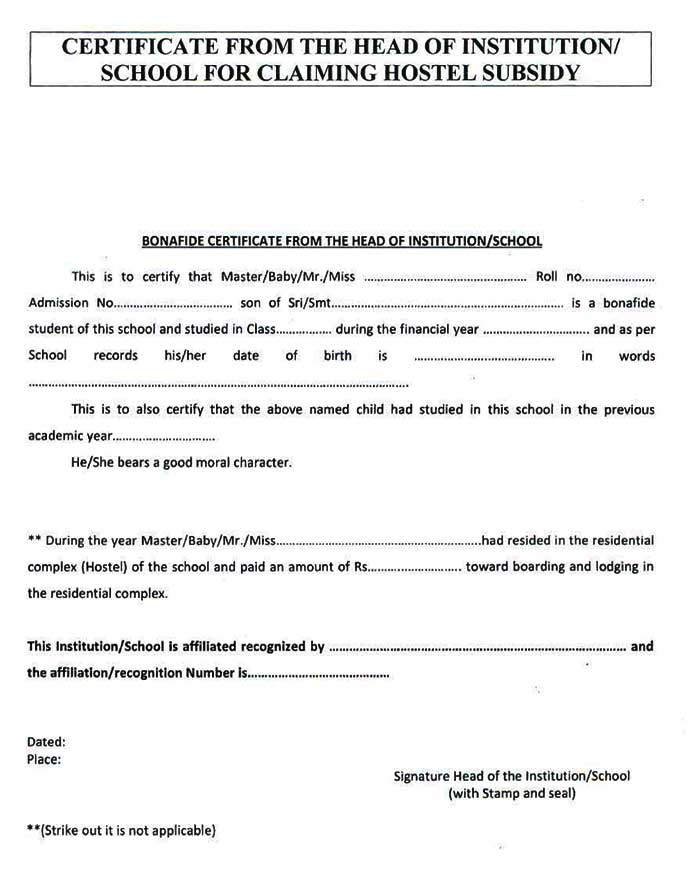

Apart from CEA, a central government employee is eligible for a monthly hostel subsidy of Rs 6,750 per month as well. The reimbursement of CEA and Hostel subsidy will be claimed only after the completion of the financial year. Hostel subsidy is applicable in respect of the child studying in a residential institution located atleast 50 Kilometres from the residence of the Government Servant.

A copy of the application of reimbursement of Children education allowance and Hostel subsidy with a bonafide certificate to be obtained from the Schools/Institution is enclosed.

Child Education Allowance Tax Exemption Limit: If your employer pays you a children’s education allowance, you will be eligible for a tax exemption under the Income Tax Act. However, the maximum amount exempted is Rs. 100 per month or Rs. 1200 per annum for a maximum of up to 2 children. In addition, under section 80C, you can exempt the costs of your children’s education

No comments:

Post a Comment